How to obtain an Licensed Manufacturing Warehouse (LMW) in Malaysia ?

LMW is a manufacturing facility available for anyone to utilize for storing goods during the production of approved products, with a primary focus on catering to export-oriented industries.

Customs duty exemption applies to all raw materials and components used in the production of approved goods, starting from the initial stages of manufacturing until the final product is fully packaged and ready to ship.

What advantages of having an licensed manufacturing warehouse (LMW) ?

LMW qualifies for identical tax benefits as the Free Industrial Zone (FIZ), entailing a comprehensive exemption from taxes on raw materials, components, machinery, and equipment directly employed in the manufacturing process.

The process for meeting eligibility criteria and submitting an application for an LMW license.

Remaining below the threshold and qualifying for tax reductions can result in substantial cost savings through LMW status. Nevertheless, a considerable number of eligible companies forego LMW status due to apprehension and confusion in the application procedures and regulations. Fortunately, the application process for LMW, although somewhat detailed, is clearly outlined and straightforward. The relevant regulations are readily available on the Royal Malaysian Customs Department’s (RMCD) website for easy reference.

Requirements for Applying for an LMW License

Manufacturers seeking import duty exemptions through LMW status must fulfill the following criteria:

- Conduct manufacturing operations in accordance with the definition of ‘manufacture’ under the Customs Act of 1967.

- Export 80% or more of the finished product, with the actual export percentage determined by the Ministry of International Trade and Industry (MITI) upon project approval. For producers exempt from licensing under the Industrial Coordination Act, Customs will ascertain the export rate under ICA 1975.

- The project must have received MITI approval, and either a license has been issued under ICA 1975 or the project is exempt from licensing under the Act (applicable if the company’s paid-up capital is less than RM2.5 million or employs fewer than 75 people).

To comply with Royal Malaysian Customs Department (RMCD) requirements, companies with LMW status must submit monthly and yearly return reports (M1, M2, and M4). The import of duty-free raw materials, equipment, or spare parts by an LMW-licensed company is subject to restrictions based on tariff codes. Consequently, companies must meticulously monitor and manage duty-exempt imports within these specified limits.

Where the Licensed Manufacturing Warehouse is Situated

To adhere to the government policy of distributing export-oriented and labor-intensive sectors to less developed areas, a company that wants to establish licensed manufacturing warehouse facilities should be situated in a less developed location.

However, there is a certain amount of freedom used in this regard. The Director General of Customs may consider issuing a Licensed Manufacturing Warehouse in such a scenario if there are substantial grounds to choose a specific region rather than one that is less established due to the unique nature of the manufacturing operation, etc.

As a result, an LMW may be positioned anywhere within the Principal Customs Area, or PCA, at the manufacturer’s discretion to situate their manufacturing operations in suitable areas regarding the availability of manufacturing materials, labor, etc. Still, such placement must be deemed appropriate by the approving authority.

It should be noted that locations deemed appropriate for LMW must be of permanent construction and be adequately secured, in the Director General’s opinion. Raw ingredients, finished items, and space designated only for the production of dutiable goods must all be stored separately in the structure.

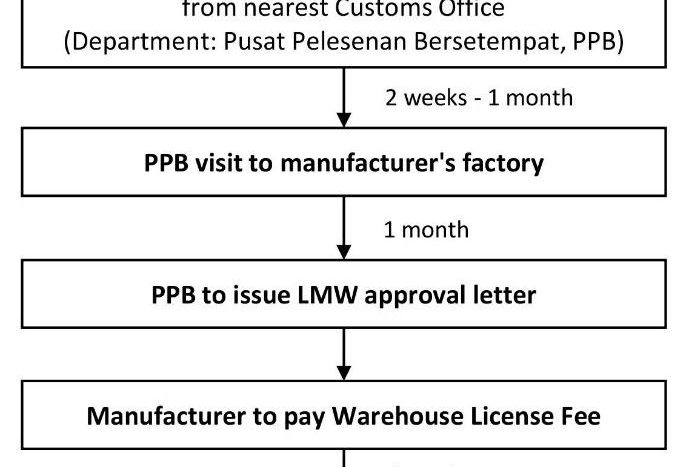

Procedures for obtaining an LMW license

- The exclusive authority to approve licenses rests with the Director General of Customs. The State Director of Customs has been permitted to exercise this power. Due to this, a request to establish a warehouse for the storage of dutiable goods (per Section 65) and to manufacture such goods for the production of other dutiable goods (per Section 65A) may be made at the same time by submitting a request to the State Director of Customs where the proposed warehouse will be located.

- Every application must be submitted using the JKED No. 1 form and any required certificates, plans, or other documentation. The application and approval processes will move more quickly as a result.

- The license thus issued shall be subject to the conditions set forth by the Director General of Customs. It is subject to renewal for a term of one or two years. At least one month before the current license expires, you must submit a renewal application.

- The license fee for successful applicants is RM2,400.00 per year.

An amount equivalent to 10% of the total duty or tax on raw materials or components for a month will need to be guaranteed by a bank. If the corporation owes no money in duties to the department, it will be returned three months after the license expiration date.

Documentation Needed for Applying for an LMW License

The documents required are:

- Covering letter

- Form JKED No. 1

- Form A: Application for Licensed Manufacturing or Warehouse under Section 65/65A of the Customs Act 1967

- Copy of the Certificate of Completion and Compliance, or CCC

- Copy of business license or certificate issued by the local authority

- Company registration documents (Forms A and D; M&A, Form 9, Form 49, Form 44, and Form 24)

- A copy of the manufacturing license issued under the ICA 1975

- Location plan, layout plan, and elevation plan (certified by a registered architect)

- Flow chart of the manufacturing process

- List of pieces of machinery and tools, raw materials and components, and finished goods

- Input/output ratio

- Rental of premises agreement letter

- A passport-size photo and copy of the IC for each director

- Other relevant documents

Licensed Manufacturing Warehouse (LMW) | Malaysia

Royal Malaysian Customs Department : Click For More

<< Similar Listing >>

For More Information Kindly Call / Whatsapp ?

Facebook : https://www.facebook.com/Industrial2u

Instagram : https://www.instagram.com/industrial2u.official/