The Unseen Costs of Homeownership in Malaysia: Quit Rent, Parcel Rent, and Assessment Rates

When purchasing a property in Malaysia, you might be taken aback to discover additional costs beyond the purchase price and monthly mortgage payments. These “hidden” or frequently “overlooked” expenses can accumulate over time, making it essential to understand them before buying a property.

The three most common “hidden” costs of owning a home in Malaysia include quit rent, parcel rent, and assessment rates. These taxes, collected by the state government and local town councils, are typically calculated based on the value of your property.

Quit Rent What is Quit Rent ?

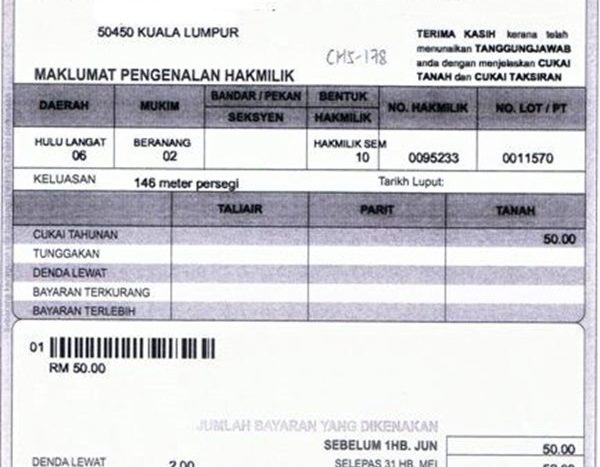

Quit rent, or Cukai Tanah, is a land tax levied on property owners by local state governments in Malaysia through the Land Office. It is a fee paid for the right to occupy and use the land on which the property stands.

As per the National Land Code, all landed property owners, including residential and commercial properties, must pay quit rent to their respective state governments.

Quit rent is typically paid annually, with the due date varying by state in Malaysia. However, most states set a cut-off date of May 31.

How is Quit Rent Calculated ?

Quit rent is a land tax imposed on owners of landed properties. It is calculated by multiplying the size of the property in square feet (sq ft) by the quit rent rate.

Here is the formula for calculating quit rent:

Property Size (sq ft) x Quit Rent Rate = Quit Rent Amount

For example, if a property is 3,000 square feet and the quit rent rate is RM 0.04 per square foot, the calculation would be:

3,000 sq ft x RM 0.04 per sq ft = RM 120.00

It is important to note that the quit rent rate may vary depending on the property’s location.

What’s Parcel Rent ?

Parcel Rent, also known as Cukai Petak, is a tax similar to Quit Rent but specifically for owners of strata properties. Strata properties are those divided into smaller units, or parcels, such as apartments, condominiums, or townhouses.

Originally, Parcel Rent was part of Quit Rent. In the past, a master quit rent was imposed on the entire strata property, and the Joint Management Body (JMB) was responsible for paying this tax. The JMB then recovered the cost from individual parcel owners through maintenance fees.

However, starting in June 2018, Selangor introduced Parcel Rent, followed by Penang in 2019 and Kuala Lumpur in 2020. This new system charges the tax directly to the individual parcel owners rather than the JMB. This change was implemented to simplify the process of selling and transferring ownership of strata properties. Similar to Quit Rent, Parcel Rent is typically paid annually.

How is Parcel Rent Calculated ?

Parcel Rent is determined based on the size of the property. This has significantly impacted costs compared to when it was calculated as Quit Rent.

Previous Quit Rent Formula for Strata Properties:

(Property Size in SQ.FT x Quit Rent Rate) / Number of Parcels = Quit Rent Amount

For example: (8,000 SQ.FT x RM 0.03 per SQ.FT) / 8 Units = RM 30

Current Parcel Rent Formula for Strata Properties:

(Property Size in SQ.FT x Quit Rent Rate) = Parcel Rent Amount

For example: (8,000 SQ.FT x RM 0.03 per SQ.FT) = RM 240

In the past, if a property of 8,000 square feet had 8 units, the ‘master’ quit rent would be RM 240, which would be distributed to 8 parcel owners at RM 30 each through maintenance fees. With the current Parcel Rent system, each of the 8 parcel owners is charged RM 240 directly.

This means the cost of homeownership for strata property owners has increased significantly under the current Parcel Rent system compared to the previous Quit Rent system.

What are Assessment Rates ?

Assessment rates, also known as Cukai Pintu or Cukai Taksiran, are local land taxes collected by local councils to fund the development and maintenance of local infrastructure and services. This tax is used to ensure the upkeep and improvement of the local area, including:

- Street lighting: Ensuring that streets are well-lit at night for the safety of pedestrians and motorists.

- Park maintenance: Activities like mowing lawns, trimming trees, and removing litter to keep parks clean and well-maintained.

- Waste collection: Regular and proper collection and disposal of garbage.

- Other miscellaneous tasks: Maintaining public toilets, cleaning drains, repairing potholes, and other similar activities.

These rates are essential for maintaining the overall quality of life in the local community.