Essential insights on stamp duty in Malaysia for buying commercial and industrial properties, covering taxes and exemptions.

Until December 31, 2021, the Home Ownership Campaign (HOC) grants full stamp duty exemptions for transfer instruments and loan agreements, subject to specified conditions, excluding buyers of industrial and commercial properties. Stamp duty is categorized into ad valorem duties and fixed duties, the latter charged at a predetermined rate, encompassing stamps for individual policies or copies.

Ad valorem duties will be imposed on:

- Instrument of transfer of property

- Instruments creating interest in property, such as tenancies and statutory leases

It is the buyer who purchases a property who is liable to pay the stamp duty.

Transfer Deed

Many people have doubts on how the stamp duty is calculated based on instrument of transfer? It is taxed based on different tiers, Let us go through a real life scenario. Say, today we have a detached factory for sale at a price of RM80 mil.

Instrument of Transfer stamp duty calculation:

= (1% x RM150,000) + (2% x RM300,000) + (3% x RM450,000) + (4% x RM75,000,000)

= RM1,500 + RM6,000 + RM13,500 + RM3,000,000

= RM3,021,000

For the Loan Agreement, applying the 0.5% stamp duty to an 90% loan for a property valued at RM120 million:

90% of RM120 million = RM108 million

Stamp duty: RM108 million * 0.5% = RM540,000.

Let's say the new detached factory is valued at RM120 million.

Stamp Duty on Instrument of Transfer = 1% of RM120 million = RM1,200,000

Stamp Duty on Loan Agreement = 0.5% of the loan amount (let’s assume the loan amount is RM40 million) = 0.5% * RM40 million = RM200,000

Stamp duty on Instrument of Transfer and Loan Agreement = RM1,200,000 + RM200,000

Total stamp duty payable = RM1,400,000

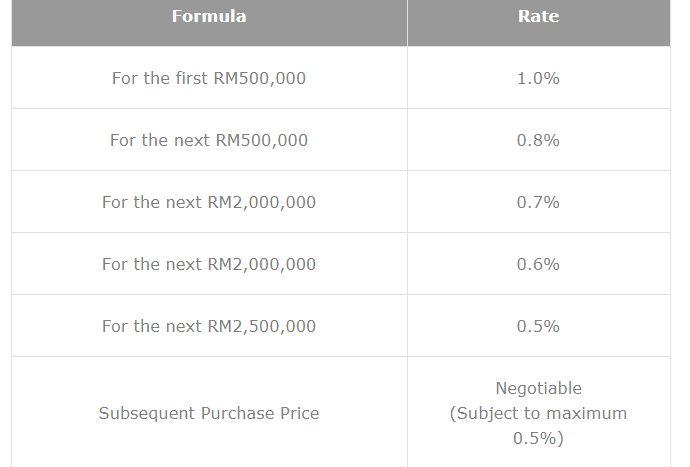

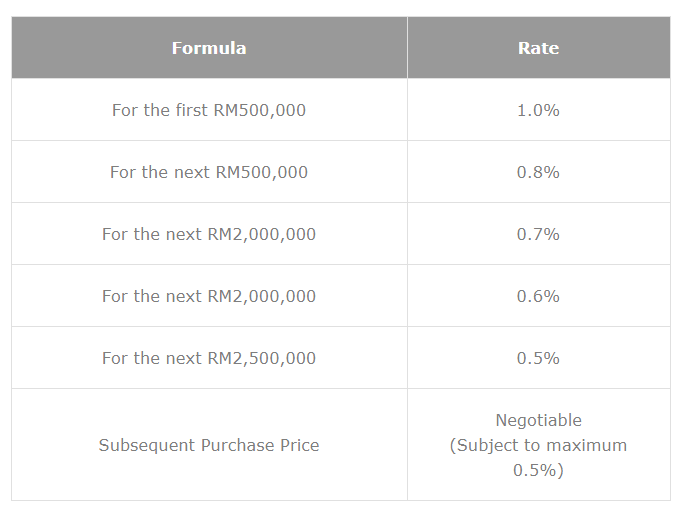

Sale and Purchase Agreement Legal Fees

When it comes to commercial loans, different banks have different criteria for assessment. Some general criteria banks are looking for are location, commercial property type, total number of floors within the building, type of unit if it is in mixed development, etc.

Stamp Duty Tax Exemptions on applicable for commercial and industrial properties

-

A 50% reduction in stamp duty is granted for the transfer of immovable property when it serves as a voluntary gift between parents and children.

-

An exception is provided for the transfer of immovable property as a voluntary gift between spouses.

-

Stamp duty is waived for all transfers of land, businesses, assets, and shares related to the conversion of a traditional partnership or private company into a limited liability partnership.

-

In the context of mergers and acquisitions, relief is available for the transfer of undertakings or shares under a scheme or amalgamation of companies, subject to certain conditions.

-

Transfer of assets between affiliated companies is also eligible for relief, where one company owns 90% or more of the other or a third company owns 90% or more of both associated companies.